PCI

What is PCI?

PCI, short for the Payment Card Industry, is a global standard for safeguarding sensitive payment card information. The PCI Security Standards Council (PCI SSC) was founded in 2006 by major credit card companies such as Visa, Mastercard, American Express, Discover, and JCB International. Its primary objective is to develop and enhance security standards for protecting cardholder data.

Importance of PCI Compliance

Compliance with Payment Card Industry standards is vital for several reasons:

- Data Security: PCI compliance protects sensitive payment card information from theft and fraud.

- Trust and Reputation: Following Payment Card Industry standards enhance customer trust and confidence in an organization’s ability to handle its financial data securely.

- Legal Requirements: Many countries have laws and regulations mandating Payment Card Industry compliance for businesses that handle credit card data, and failure to comply may lead to legal repercussions.

- Financial Consequences: Non-compliance may lead to fines imposed by regulatory bodies and penalties from credit card companies.

Payment Card Industry Standards

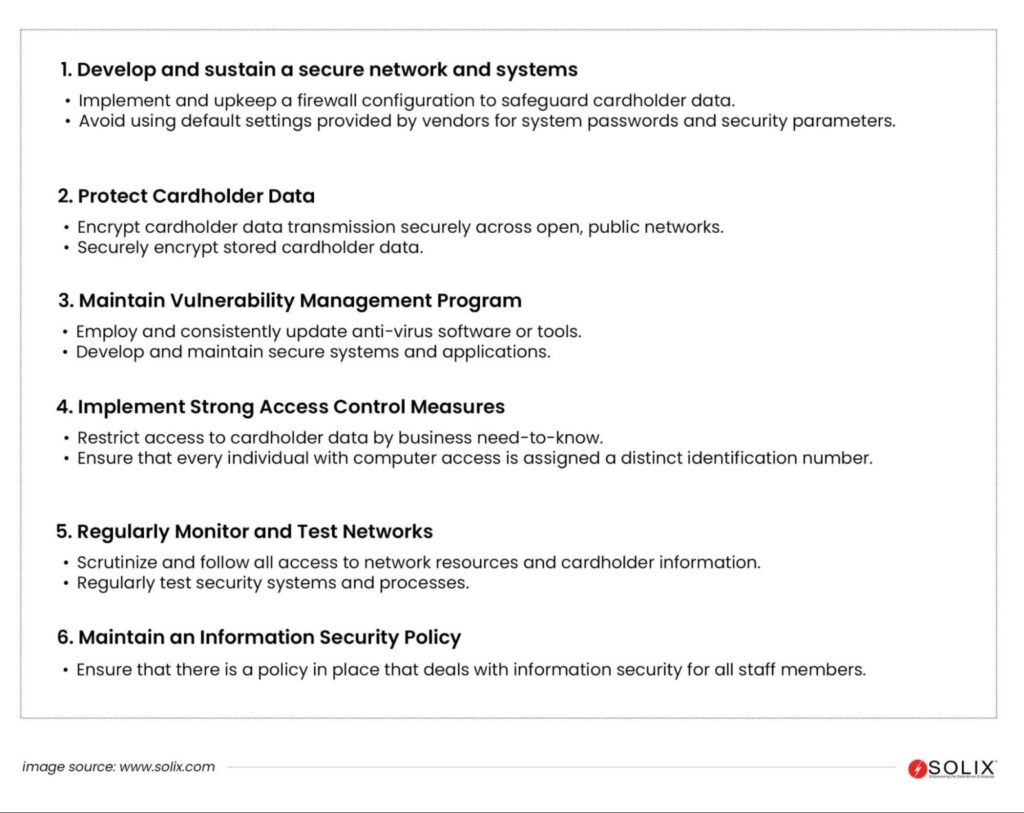

PCI isn’t a single certification but a set of ongoing requirements. The PCI Data Security Standard (PCI DSS) is the core framework for Payment Card Industry compliance. It consists of twelve requirements organized into six categories:

Who Needs to Comply with PCI?

Any entity that retains, handles, or sends cardholder information must adhere to PCI DSS regulations. This applies globally regardless of the business size or the number of transactions they handle. Here’s a breakdown of who typically needs Payment Card Industry compliance:

- Merchants: This includes any business that accepts payment cards (credit, debit, prepaid) in person, online, over the phone, or through a mobile app.

- Service providers: Any company that stores, transmits, or processes cardholder data on behalf of merchants needs to comply. This includes payment processors, gateways, and any third party involved in the payment flow.

Even if you outsource your payment processing, you’re still responsible for ensuring your chosen vendor is PCI-compliant.

Who Oversees PCI?

The organization that oversees PCI is the Payment Card Industry Security Standards Council (PCI SSC), which manages and evolves the security standards. The PCI SSC is an independent body founded by major payment card companies like Visa, Mastercard, American Express, Discover, and JCB International.

Non-Compliance Fine

There isn’t a single set fine for non-compliance with PCI standards. The penalties are imposed by payment brands (Visa, Mastercard, American Express, Discover, and JCB International) and acquiring banks, not directly by the PCI SSC itself. Here’s what you can expect:

- Fines: These can range anywhere from $5,000 to $100,000 per month, depending on the severity of the non-compliance and how long it persists. Fines typically increase the longer you remain non-compliant.

- Increased transaction fees: Non-compliance can also lead to your payment processor charging you higher fees for each transaction you process.

- Termination of service: In extreme cases, your acquiring bank may terminate your ability to accept card payments altogether.

How to Achieve PCI Compliance?

To achieve Payment Card Industry compliance, organizations must:

- Understand the PCI DSS requirements applicable to their environment.

- Conduct a thorough assessment of their systems and processes to identify vulnerabilities and gaps.

- Implement appropriate security controls and measures to address identified risks.

- Regularly monitor, test, and update security systems to ensure ongoing compliance.

- Work with Qualified Security Assessors (QSAs) or Internal Security Assessors (ISAs) to validate compliance through audits and assessments.

In conclusion, Payment Card Industry compliance is essential for any organization processing, storing, or transmitting credit card data. By adhering to Payment Card Industry standards, businesses can mitigate the risk of data breaches, protect their reputation, and maintain the trust of their customers. It is crucial to stay updated with the latest PCI requirements and continually improve security measures to adapt to evolving threats in the payment card industry.

FAQ

Is Payment Card Industry compliance mandatory for all businesses?

Yes, Payment Card Industry compliance is mandatory for any organization that processes, stores or transmits credit card data. Non-compliance may lead to fines, penalties, and harm to reputation.

Does Payment Card Industry compliance apply to businesses outside the United States?

Yes, Payment Card Industry compliance is a global standard applicable to businesses worldwide that handle credit card data. It is crucial for any organization that conducts transactions involving payment cards.

Are there different levels of Payment Card Industry compliance based on transaction volume?

Yes, Payment Card Industry compliance levels are determined by the volume of transactions processed annually. Levels range from Level 1 (highest) for organizations with the largest transaction volumes to Level 4 (lowest) for those with the fewest transactions.